From 1 November 2021, a new compliance requirement has been introduced for all company directors

From the 1st November 2021 company directors need to verify their identity and obtain a Director Identification Number (DIN)

A DIN is a unique identifier that will attach to a director forever

The purpose of the DIN is to prevent the use of false or fraudulent director identities, and to identify company phoenix activity

All company directors require a DIN. Existing directors have until 30 Nov 2022

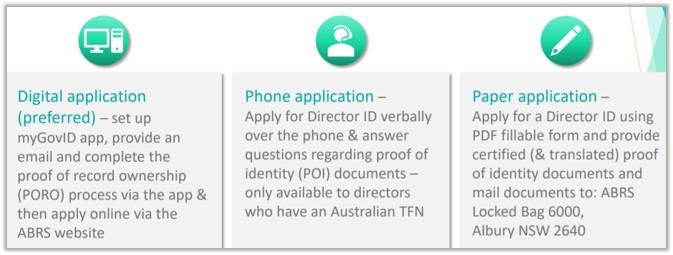

Please note, you need to do this yourself, we are not allowed to do this on your behalf MyGovID app on phone: (skip this step if already have myGovID)

MyGovID app on phone: (skip this step if already have myGovID)

MyGovID app on phone: (skip this step if already have myGovID)

Step One

Setup MyGovID app on phone: (skip this step if already have myGovID) Setup MyGovID app on phone: (skip this step if already have myGovID)

Mac/Apple link: https://apps.apple.com/au/app/mygovid/id1397699449 MyGovID app on phone: (skip this step if already have myGovID)

Set up your myGovID using two of the following Australian identity documents to achieve a Standard identity strength (your name must match in all):

· Passport Setup MyGovID app on phone: (skip this step if already have myGovID) MyGovID app on phone: (skip this step if already have myGovID)

· Driver’s Licence MyGovID app on phone: (skip this step if already have myGovID)MyGovID app on phone: (skip this step if already have myGovID)

· Medicare card MyGovID app on phone: (skip this step if already have myGovID)MyGovID app on phone: (skip this step if already have myGovID)

Step Two

You will need to prove your identity with

· Tax file number (TFN) MyGovID app on phone: (skip this step if already have myGovID)

· The residential address (as held by the ATO) MyGovID app on phone: (skip this step if already have myGovID)

· Information from two documents to verify your identity. MyGovID app on phone: (skip this step if already have myGovID)

Examples of the documents you can use to verify your identity include: MyGovID app on phone: (skip this step if already have myGovID)

· Bank account details (as held by the ATO MyGovID app on phone: (skip this step if already have myGovID)

· an ATO Notice of Assessment reference number MyGovID app on phone: (skip this step if already have myGovID)

· Super account details MyGovID app on phone: (skip this step if already have myGovID)

· Dividend statement MyGovID app on phone: (skip this step if already have myGovID)

· PAYG payment summary MyGovID app on phone: (skip this step if already have myGovID)

· Centrelink payment summary MyGovID app on phone: (skip this step if already have myGovID)

Step Three

Log in and apply for your DIN

Apply for your director ID | Australian Business Registry Services (ABRS)

The application process should take less than 5 minutes MyGovID app on phone: (skip this step if already have myGovID)

Once you complete the application you will need to download a PDF record of your DIN MyGovID app on phone: (skip this step if already have myGovID)

Please send us the DIN so we can keep on file for you MyGovID app on phone: (skip this step if already have myGovID)

Of course you will be substantially penalised if you do not obtain a DIN within the timeframe MyGovID app on phone: (skip this step if already have myGovID)